For farmers and growers in the pig, poultry or horticulture sectors your climate agreement data must be submitted at the start of 2019.

The 31 December 2018 marks the end of this reporting period for all participants on the NFU Climate Change Levy Scheme. We will be opening our online CCL data return on 01 January 2019 to allow all registered participants to submit their 2017 -2018 energy and production data. Under the CCL scheme, eligible businesses receive a discount in return for meeting energy efficiency or carbon-saving targets which they have to report every two years. The current discount is 90% for electricity and 65% for natural gas, LPG and for other qualifying fuels.

What do you need to do now?

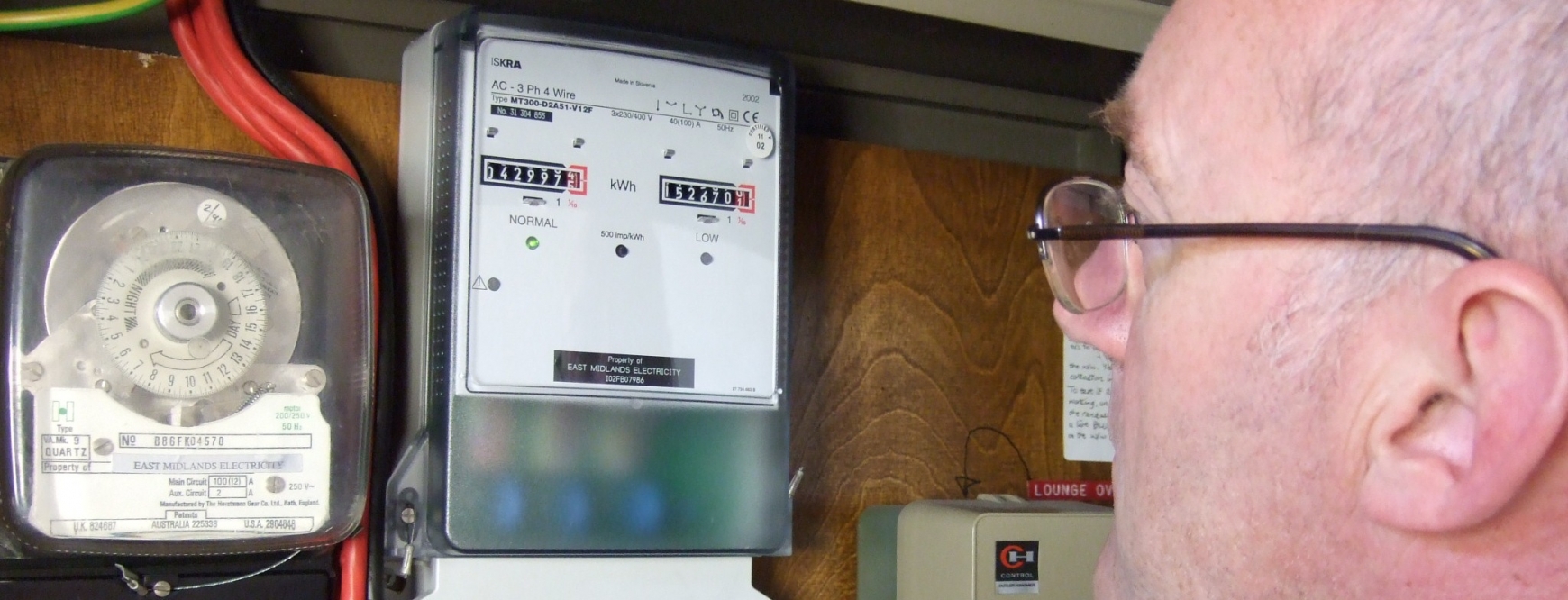

- Check that your energy use and production records since 01 January 2017 are up to date. Your records will need to include:

- Your production records (for most horticulture sites this is production area)

- Usage data for all fuels including renewables

- Export data for any electricity you have generated on your site/s

- Make sure any invoices have been checked against your own meter readings and you have resolved any discrepancies with the supplier. If you find any issues that can’t be resolved, ensure you have the necessary documentary evidence.

- Be ready on the 31 December 2018 to take meter readings and stock-take any bulk fuels. If you can’t do so on this date, make sure the readings are as close to this date as possible.

CCL data returns must be submitted on our online system no later than 31 March 2019. This is so we have time to collate the sector submissions due at the Environment Agency by May 2019.

From April 2019 CCL rates are due to rise substantially and the value of being a CCL member will increase for all participants. Members’ CCL relief rates will also increase from 90% to 93% on import electricity and from 65% to 78% on Gas, LPG, Coil and Coke, triggering a requirement to complete a new PP10 and PP11.

Members who meet their reduction target will be certified to claim CCL relief for another two years. Those who do not meet their target and who wish to remain on the CCL scheme will be expected to make a payment to cover the shortfall.

More information about the reporting period and increases to CCL rates will be issued nearer the time to the registered CCL contacts.

If you have any questions contact us at [email protected] or by calling us at 024 7669 3043.