In his budget speech on March 16th, George Osbourne made some interesting energy related announcements. For many, the most significant news was that the Carbon Reduction Commitment Energy Efficiency Scheme (known as the CRC) will end on 1st April 2019. Alongside this announcement came the news that CRC will be replaced, in a “revenue neutral” way, by increasing Climate Change Levy (CCL) rates.

There are only around 2,100 CRC participants, and these businesses will certainly be happy to hear that they won’t be paying the costs of participation after 2019. On the other hand, almost every business pays CCL so increased CCL rates are going to have a far wider impact, by increasing energy costs for the majority.

The exception to this comes from having a Climate Change Agreement (CCA), and this is because CCA holders get a discount on CCL. The Chancellor made two interesting announcements that related to CCA’s. Firstly, he confirmed that CCA’s will continue until 2023 and secondly, we were told that the CCL discount rates for CCA holders are going to rise. This means that the value of having a CCA will increase from 2019 onwards.

Here at FEC, we run three sector CCA’s for the National Farmers Union (NFU) and we’ve calculated that the value of these agreements, to its members, will increase in 2019 from £4.9M to £8.9M per year.

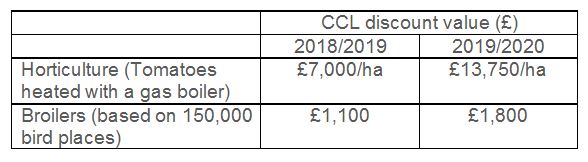

As for the impact on individual NFU’s scheme members, the table below shows how savings will go up. Here you can see that tomato growers in the NFU’s horticulture scheme will virtually double his savings, whilst a chicken producer in their poultry scheme will increase his savings by 63%.

So, the message is quite clear. Unless you have a CCA then your CCL costs are set to increase significantly in the future. On the other hand, being a member of a CCA is going to be significantly more valuable.