Pre-winter 2019-2020

Changes to TRIAD Rates

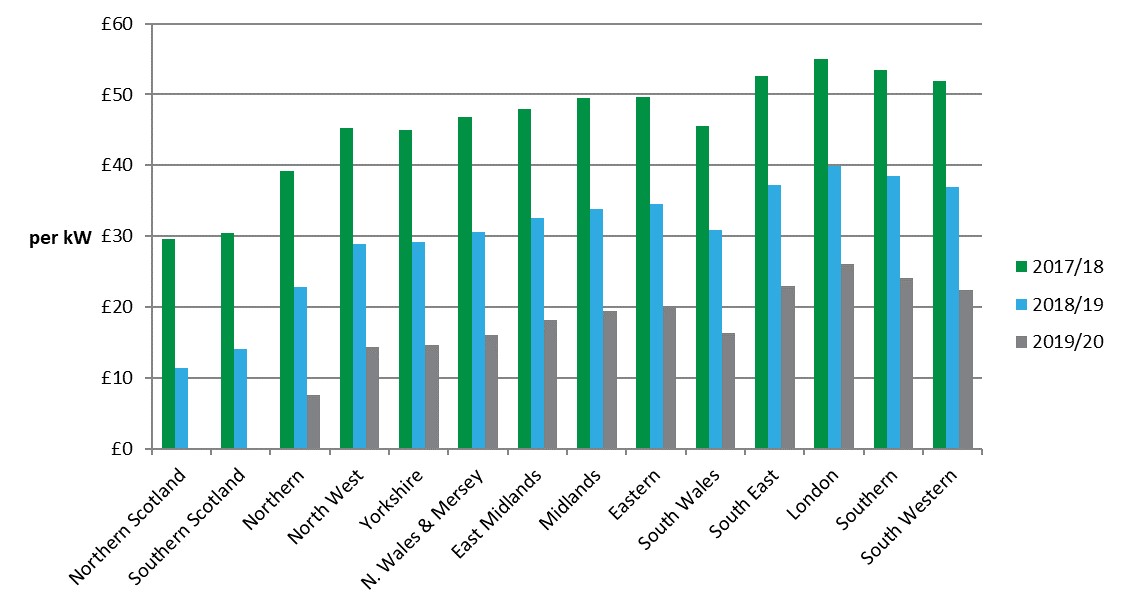

Last TRIAD season, the government’s plans to steadily reduce TRIAD income available to generators were finalized, and the first step in reducing the rates was implemented. Export payment rates saw an average reduction of approximately 35% when compared to the previous year, though some areas experienced a much higher reduction than others.

This year sees the cutting of rates continue at an accelerated pace. The average level of reduction has increased, to around 45% of what was paid last season - with the rates for Scotland being removed entirely, and the rates for Northern England facing greater reductions than the south.

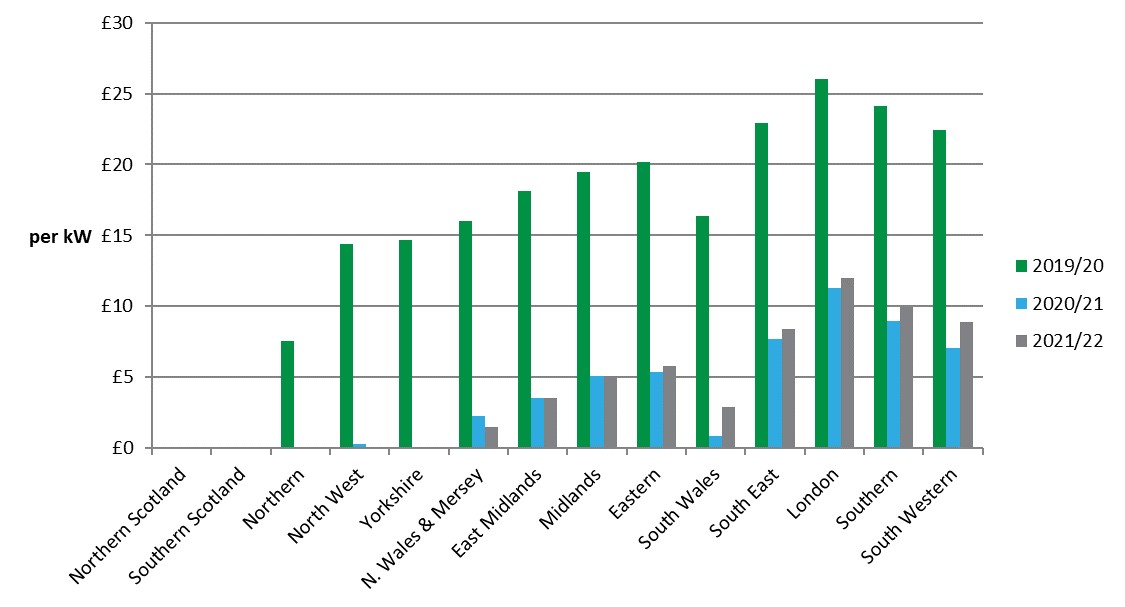

This year marks the last TRIAD season before the rates make their final reduction to a fraction of what they were originally, and in many cases, to zero. National Grid’s forecast of the upcoming five years’ of TRIAD rates makes the upcoming reductions in tariffs clear - export rates for most areas reduce down to levels approximately between £3/kW and £7/kW before coming to a rest. Rates for North of England follow in the footsteps of those of Scotland for this year – their tariffs are removed entirely as of the 2020/21 season, so this is the last opportunity for income to be earned by generators in these areas.

As with last year, the importance of chasing the TRIAD income this season before further rate reductions are applied cannot be understated, especially for the Northern zones. Whilst rates have continued to reduce, and the divide between the rates for North and Southern zones increases, there’s still money to be earned, with the lowest (Northern England) being worth £7.57/kW exported and the highest (London) being worth £26.04/kW.

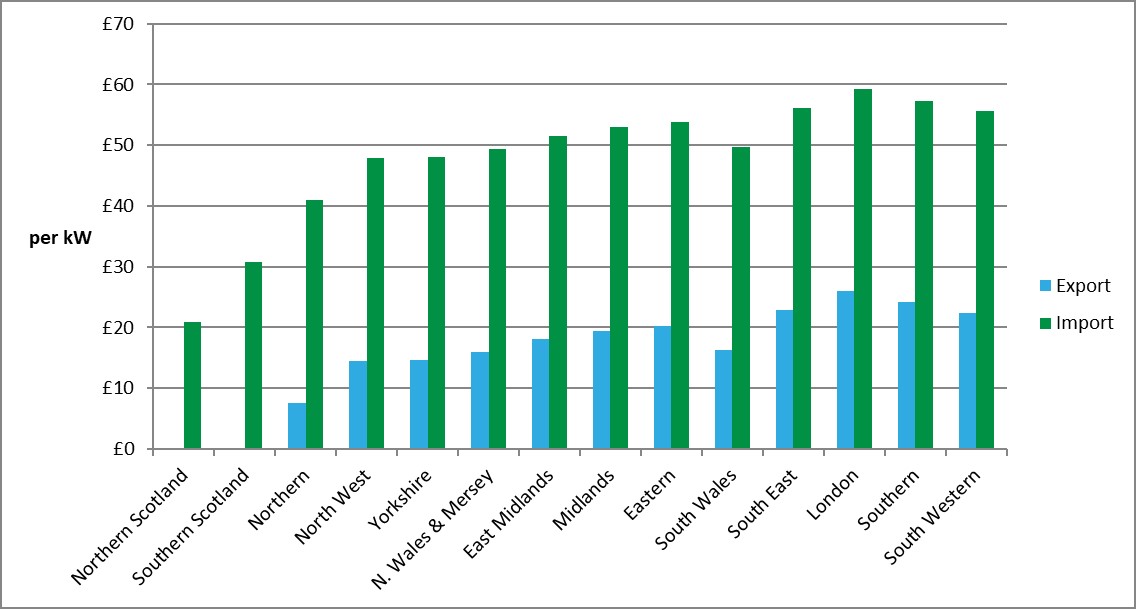

It is also equally important to consider potential costs arising through TRIADS when power is imported. Rates are imposed as costs on importers, so avoiding these charges should still be prioritised whenever possible. This is even more critical this year – as whilst the generation tariffs have steadily reduced, the tariffs for importing power during TRIAD periods have remained largely the same. Avoiding these hefty import fees can now almost be considered more critical than ensuring the maximum amount of export income is achieved!

The below graph demonstrates the current difference between the import and export tariffs:

Pre-winter 2019 2020

History can help us to narrow down the days and times when TRIADs are most likely to happen. Whilst this tells us when a TRIAD has never occurred and when they are more likely, there are no guarantees. The information that follows is based on data published by the National Grid, covering all the TRIADs from the 1990/91 season onwards.

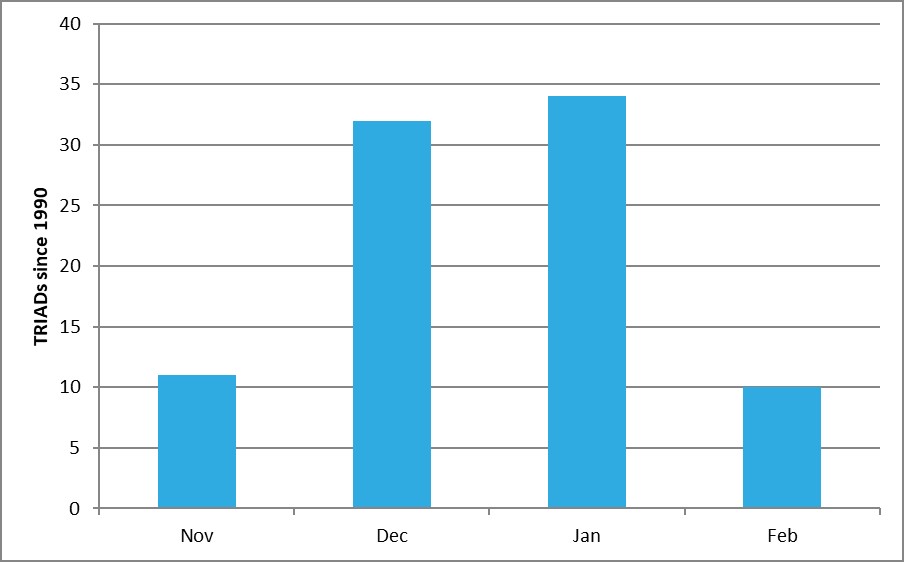

Analysis by month

Looking at the graph below, you can be almost certain that there will be at least one TRIAD in December and one in January. However, it is fairly rare for there to be no TRIAD in either November or February in any given season. This last occurred in 2016/2017.

Looking at November:

- The earliest a TRIAD has been was the 17th November in both 1992 and 1998.

- Last season there was a TRIAD on the 22nd of November.

Looking at December:

- Since 2011, all TRIAD calls during December have been within the first fortnight of the month.

- There have been none during the Christmas break - the latest in December was the 20th in 1999, 2006 and 2010.

- Last season, there was a TRIAD on the 10 December.

Looking at January:

- Generally, there is a fair distribution of dates throughout January.

- The earliest being the 3rd in both 2002 and 2008.

- Last season, there was a TRIAD on the 23 January.

Looking at February:

- The latest TRIAD has been during this month was 26th February 2018.

- Last season, there was no TRIAD during February.

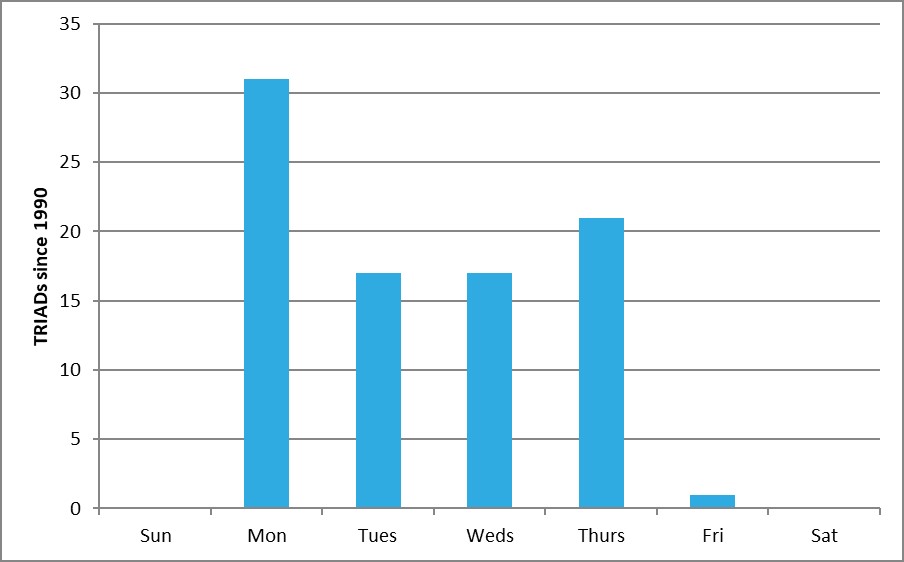

Analysis by day of the week

No TRIADs have ever been recorded on a Saturday or Sunday.

Until 2013, there were no TRIADs on a Friday (6th December).

With regards to Monday through Thursday, Monday has a respectable lead with regards to TRIAD dates. Looking at historic results there is a high likelihood of a TRIAD occurring on any of these four days – Friday is definitely the ‘outlier’.

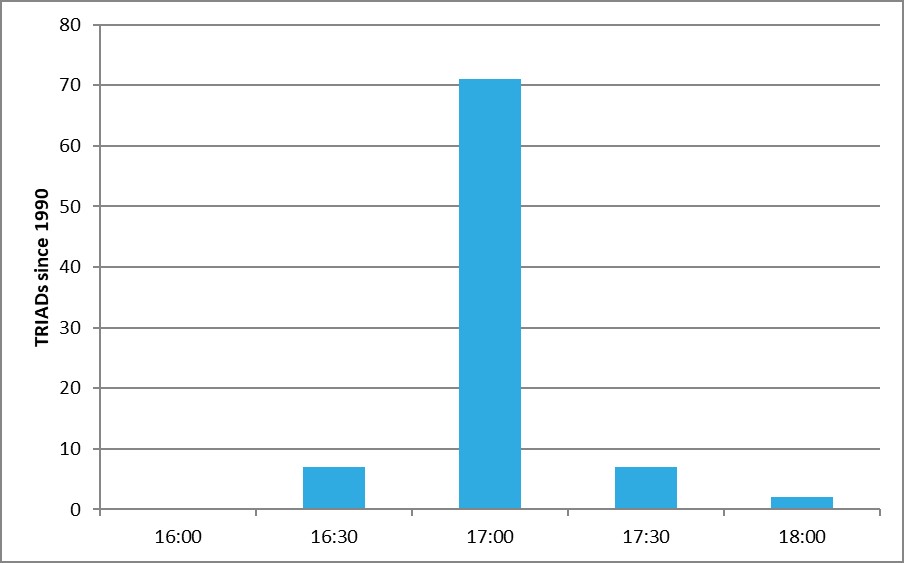

Analysis by the time of day

Important – TRIADs are quoted by National Grid as the half-hour ending, whereas electricity meter data is generally quoted at the half-hour starting. We have reported TRIADs as the half-hour starting as this is how most suppliers present the half-hourly meter data. The graph below shows that the overwhelming majority of TRIADs (90%) are between 17:00 - 17:30.

- In the last 10 TRIAD seasons (30 Triads in total):

- 24 were 17:00-17:30

- 4 were 17:30-18:00

- 2 were 18:00-18:30

- The last time a TRIAD was 16:30 - 17:00 was 17th December 1997.

- The last time a TRIADs were called during the 17:30 - 18:00 and 18:00 – 18:30 periods was in the 2017-2018 season, on the 5th and 26th February 2018, during the ‘Beast from the East’ cold front.

- Last season, two TRIADS were called during the 17:00-17:30 bracket, and one during 17:30-18:00.

Key drivers

The key drivers that affect when there is a TRIAD are:

- Combination of industrial and domestic demand

- The overlap between some industry still running and people getting home from work gives a reliable peak around 17:00 - 18:00.

- A reasonable amount of industrial use still ends the working week at lunchtime on a Friday. Therefore explaining why there is rarely a TRIAD on a Friday.

- Weather

- Generally, if it is cold, electricity demand is higher.

- Street lighting

- As day-length increases towards the end of February, the overlap with domestic use thins out. Explaining, in part at least, why there is rarely TRIAD after the first week of February.

However, we are seeing a trend of more industrial users turning equipment off when there is a TRIAD warning, which is making TRIADs overall less predictable. There are also more embedded generators (connected to the local distribution network) hoping to earn TRIAD income that reduces the demand on National Grid. Combined these make TRIAD prediction increasingly difficult.

Your TRIAD strategy

So, armed with all of the above, what approach are you going to take this winter, or perhaps, what approach would we take?

- Not worry about TRIADs too much until 7th November, possibly a week later if it isn’t cold.

- Focus on Monday – Friday inclusive.

- Focus on 16:00 - 19:00

- Power prices during this period also tend to be high.

- Relax over the Christmas – New Year holiday period.

- Not worry about TRIADs after mid-February, unless it is exceptionally cold and/or winter has been very mild so far.

Pull this all together and there are only around 60 days out of a theoretical maximum of 120 days when it is likely there will be a TRIAD, and we can be fairly confident they will happen between 16:00 - 19:00. ‘Expert’ TRIAD warning services typically issue 25 TRIAD warnings in a season. Therefore, after a bit of simple logic (above), they are issuing a TRIAD warning, on average, slightly less than every other ‘likely TRIAD’ day.